8 Bad Money Habits That Keep You Poor (part I)

What is the biggest obstacle between living paycheck to paycheck and financial freedom? Hint: it’s not winning the lottery.

It’s knowledge. Knowing exactly where your money’s going. Because if you don’t know? It’s impossible to know what needs to change.

Here’s part one of my eight common money habits that are keeping you poor (and tips on how to change them!)

1. Bad money habits that keep you poor: not keeping track

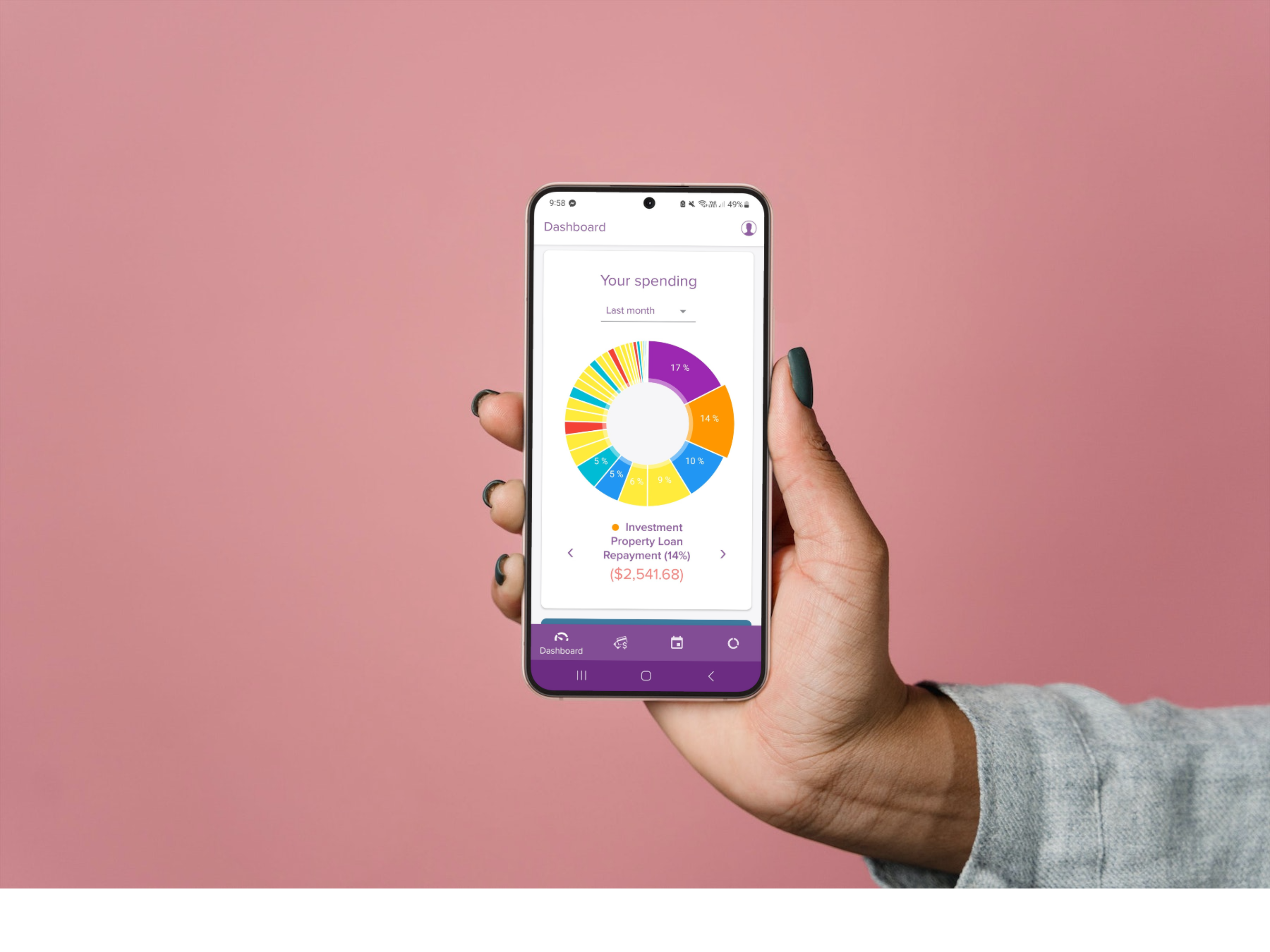

The number one new habit you need to form? Give every dollar a purpose and a job. Create a budget, and allocate a proportion of your income to specific tasks. And ensure you stick to it with a tracking app.

Every dollar should be allocated to necessary expenditure, savings, and paying off debt. I’m not saying don’t have fun. You absolutely MUST include an allowance for fun in your budget. In fact, planning for fun spending is vital if you want to create a budget you can stick to.

2. Bad money habits that keep you poor: living beyond your means

It may seem obvious that this habit will put you on the express train to F*cked Up Financeville. But it happens all the time.It starts small. But with the plethora of credit options available, it’s a slippery slope to getting in over your head.

One of the biggest villains? New cars. Not only do new cars lose 10-15% of their value the second they leave the dealership, they’re often unnecessary. Unless your finances are in tip top shape, I’d reconsider that brand new car.

Other villains include credit cards, store cards, AfterPay, ZipPay and OpenPay. If you don’t have the money now? You don’t have the money.

3. Bad money habits that keep you poor: regular impulse buying

20% off? For 72 hours only? Quick! Add to cart, check out, and enjoy that dopamine hit.

Sound familiar?

Bargain or not, regular impulse buying is a dangerous habit. Often, it means you’re spending outside your budget. Which can make your cash flow plan turns to shit. And the surplus that should go into savings? Poof — gone.

Try this instead. When you feel the urge, wait. If after three days, you’re still keen, by all means — indulge.

But before you do, consider this: those marketing emails piling up in your inbox are made to manipulate you. And studies show that the joy of the online search and transaction actually surpasses the pleasure you’ll get when the item arrives. I’m not suggesting you give online shopping the flick on a permanent basis, of course. Just try to be a bit more mindful about what you’re buying each month and how it aligns with your financial goals and values.

4. Bad money habits that keep you poor: confounding compounding interest

If credit card debt is a villain, compound interest is a supervillain.

Any debt you have? It’s accruing interest. Interest that’s continually increasing the balance of your debt. But compound interest? It’s the additional interest you accrue on the original amount borrowed, PLUS interest on the interest. I know — appalling.

But you can avoid it. Make paying off any debts a priority. You can make this happen by managing your budget to live in surplus and focus on paying off debt sooner. Don’t repay just the minimum. Pay off as much as you can. With a bit of planning, you can save heaps on interest. Dust off your cape and crush the compound interest supervillain!

Change your bad money habits — today!

Here’s the thing: these habits are robbing Future You. And the longer you delay changing them? The more joy you deny yourself.

You have the knowledge now — it’s time to take action. Give clear jobs to your dollars. Live within your means. Spend mindfully. And crush debt.

Need more persuading? In part two of this series, I have four more bad money habits for you to break ->

And if you want judgement-free support as you change your habits, my values-based budgeting service will get you on track.

Do you have a copy of the free budget guide?

Learn about your Money Mindset and six (yes SIX!) budgeting styles (and find the one that works for you!)

We hate SPAM. We will never sell your information, for any reason.